Few things are certain in life and legacy income is one of them, as Richard Radcliffe points out

George Bernard Shaw, a great man who fell out of an apple tree and died in his 90s, said: “We are made wise not by the recollection of our past, but by the responsibility for our future.”

To change the world of legacy giving we must each influence major changes, but how easy is it to that? Legacy fundraising is unique because it is:

- the only source of income which cannot be forecast in the long term;

- the only source of income with an unknown return on investment;

- the only source of income which trustees are hesitant to invest in;

- a long-term investment which underpins the financial position of many charities; and

- the only source of income which trustees think ‘just comes in’.

Dangerous expectations

The misinformation on legacies outweighs the information. Many of us (including me) love to quote statistics such as the average cash-legacy value or the average residuary-legacy value. However, these statistics set benchmarks, for trustees and others, which can be entirely misleading.

The average cash legacies for universities are on another planet compared to the average cash legacies for animal charities and the biggest charities tend to get bigger residuary legacies than smaller charities. So is there any point in giving performance indicators which are so sensitive to each causal area?

What I find particularly scary after so many years specialising in legacies are the fluctuations in legacy income – they are far more pronounced now than in past years. Almost daily I’m asked what I think charities’ legacy incomes will be next year and how they can forecast. The answer is, to be honest, I don’t know.

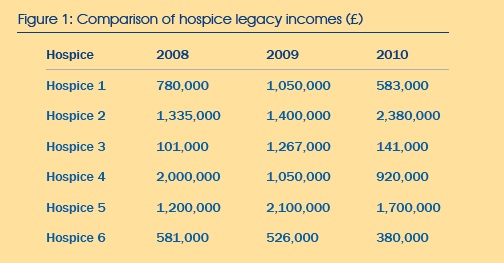

You only have to look at Figure 1, which shows six hospices. On average, they get 20 per cent of their total income from legacies but, again, that is a dangerous statistic because it all depends on so many variables.They are similar in that they are all adult hospices which have been in existence for over 15 years. So why is there no common picture?

Influences not trends

My view is simply that there have never been so many changing influences affecting legacy income. The number of deaths is predicted to decrease each year until roughly 2015 but they went up slightly in 2010. The economic situation is so volatile that nobody can forecast share or property values from one day to the next, let alone over the coming 12 months.

People of 65 and over are concerned about the cost of care and are hesitant to include a charity in their will until they know how much they will need to survive. As a result legacies are not going into their will but into a letter of wishes. These are not seen by Smee & Ford and therefore can’t be used as an indication of potential legacy income.

People are also opting to write a letter of wishes concerning their charity legacy rather than update their wills because of the associated cost. The danger in a letter of wishes is that it is not legally binding, unlike a Codicil. There is no such thing as a standard letter of wishes; so there is little a charity can do to promote it and even if you did, it’s probably too risky because it can be changed in a flash.

As the older population runs out of cash, they are taking out capital or equity release schemes. This means they don’t own the house they want to leave to charities, or family members. Legacies are being put in and taken out of wills at an alarming rate as charities are perceived as intruding on the privacy of prospects, who are getting fed up with aggressive techniques.

Other concerns, such as the financial security of grandchildren, paying university fees and the obvious one – having a really good time and spending the lot before you die (that’s me), are also rumbling dimly in the background.

Let’s just stop and think for a minute. With all these variables, can we really forecast the future? Add the hesitancy of trustees to invest in legacies to the mix (because the benefits will be reaped after they have finished their trusteeship) and we are walking into an unknown.

Enough of being Mr Grumpy, let’s be optimistic like Steve Jobs was when he delivered this remarkable speech at Stanford University in 2005:

“Remembering that you are going to die is the best way I know to avoid the trap of thinking you have something to lose. You are already naked. There is no reason not to follow your heart… Death is the destination we all share. No one has ever escaped it. And that is as it should be, because death is very likely the single best invention of life. It is life's change agent. It clears out the old to make way for the new. Right now the new is you, but some day not too long from now, you will gradually become the old and be cleared away. Sorry to be so dramatic, but it is quite true.”

Change agents

We have to change the attitude of the public towards dying and leaving a legacy. Initiatives such as Dying Matters are beginning this work, but we have barely started. We have to change the attitudes of trustees by getting rid of their ‘it will come in anyway’ approach and their short-termism. We must petition for change through professional bodies such as the Institute of Fundraising and ACEVO.

We need to change the views of The Law Society to be more supportive of Codicils so that taking action is easy for our prospects. No letter, website or newsletter is going to result in a massive attitudinal earthquake which destroys the barriers currently confronting legacy fundraisers.

It always fascinates me in focus groups to hear why people donate to charity: ‘I got a really nice letter’, ‘the guy in the street was great’, ‘I have always wanted to give to charity and I got this letter’ or ‘I heard about them and went onto their website’. When I ask why they have put a legacy in their will however, they answer ‘because I wanted to’. Never do I hear ‘because I got a letter’ or anything similar. It is only when I ask them why they took a legacy out of their will that they say it was due to a letter or a call. We need to clear out the old barriers and make way for a new world of legacy giving. Sorry to be dramatic but it is quite true. Thank you Steve Jobs.

When Steve Jobs died I got a text from my son, Harry. It read “Ten years ago we had Steve Jobs, Bob Hope and Johnny Cash. Now we have no jobs, no hope and no cash”. True but many older people still have properties or other assets that they can give a small part of to their favourite charity.

If we really want this to happen then the big barriers must fall and we can then be responsible for a good future. Now, I must go and prune that apple tree…

Richard Radcliffe is a legacy consultant with Smee & Ford

This article first appeared in The Fundraiser magazine, Issue 12, December 2011