Capital grant funding is a competitive market place with big challenges for charities on demonstrating impact. Cathy Pharoah shares ideas on how to make the best cases.

Charities cannot operate efficiently and sustainably without adequate infrastructure investment, whether in the equipment, buildings, facilities or IT essential to delivering projects and services. When resources are tight, however, such resources are a tempting target for economies, for making savings by ‘making do’.

So what is happening to the availability of capital grant funding at a time when government expenditure is falling, and the need for charity services is growing? This article looks at findings on the state of capital grant funding from unique research commissioned by the Clothworkers’ Foundation, and the messages which emerged. Are funders switching priority from investment in the sector’s infrastructure towards meeting frontline service needs? Is it harder to get funding for capital items? How can charities make the best funding case for the capital items and buildings which often play a pivotal role in developing organisational and community capacity?

The value of capital funding

Capital grant funding clearly has a very significant place with funders. The total value of trust capital grants is estimated conservatively in the research at £178 million per annum, one-quarter of overall foundation spending (excluding the major Wellcome Trust and Big Lottery Fund). At least 575 foundations will consider capital grant funding, and it ranges between 10% and 80% of their spending.

It is also of the utmost importance to fundraising charities. Over half of the applicants and grantees in the survey research rated capital funding as ‘essential or very important’, and a further one-third as ‘important’. Many gave vivid examples of how capital funding is essential to their ability to grow and deliver quality services, such as:

"We operate in an old building which requires much updating... without capital funding our building, over time, would become unusable…."

"Large site in need of constant renewal. Tatty environment is depressing…"

"In order to expand our work, achieve our ambitions for impact, investment in infrastructure is essential…to take our work to an appropriate level."

"Without our capital grant we could not have increased our activities and services to the local community when the council are cutting services."

A competitive market-place

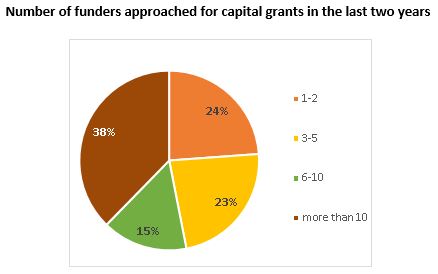

Charities are very active in raising capital grant funding. The research, which was carried out on charities with incomes below £10 million per annum, showed that 38% had approached at least ten funders for capital grant funding over the last couple of years. The graph below shows the high levels of applications being made, with almost two-fifths (38%) approaching more than ten funders in the previous two years.

It is also the case that demand is outstripping supply, and this leads to growing competition for such funds. Half of the funders surveyed made 20 or fewer capital grants per annum, although nearly three-quarters received a higher number of requests than this.

All the indications are that things will get tougher, and that capital grant funding has taken a particular hit in the current funding climate. Applicants and grantees in the survey overwhelmingly reported that the availability of capital grant funding had reduced.

This picture was confirmed with evidence that one-quarter of funders reported reduced capital grant funding in the last two years, although only 5% had reduced their spending overall. Where foundations had increased their spending, only half had dedicated any of the increase to capital grants.

The overwhelming reason for the drop in capital grants was the pressure to increase support for revenue and core, and to ‘keep essential services running’ where there is reduced government spending and weak economic growth.

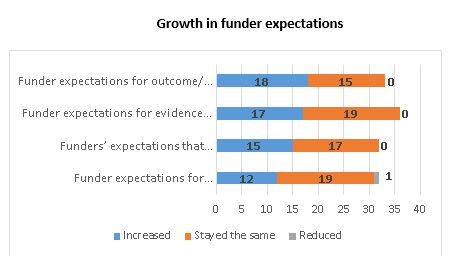

This environment also generates increased pressure to demonstrate effectiveness in spending. One funder said it was easier to show impact in core or revenue funding, while another felt under pressure from other funders to give more priority to these areas. Some seemed under a mistaken impression that others were filling shortfalls in capital funding. Funders’ expectations from the grants and grantees have also been growing, as the next graph shows.

Demonstrating outcomes and impact

Demonstrating impact is challenging whatever the area of activity or intervention. Capital grant funding is not a special case, but its benefits can be subtle and not as easy to demonstrate, for example, as in access to new educational or health programmes where beneficiary improvements can be relatively easily measured.

In the research three different outcome areas were identified – beneficiary services, organisational capacity and wider/local environment. Overall remarkably high levels of benefits were reported by both funders and grantees in all three.

For both funders and charities, the area attracting the highest number of ‘very positive’ ratings was ‘improved outcomes for services, activities and products’. For funders the area receiving the next highest rating was ‘creating or securing a local asset’. However, a difference emerged between them and fundseekers, who gave ‘staff morale and satisfaction’, and ‘organisational reputation and status’ the second highest importance.

The results suggest that at a time of pressure, funders may emphasise external over internal benefits of capital grants. Fundraising charities need to be prepared to emphasise the external benefits to people and places, and where possible, attempt to place some quantification or value on them.

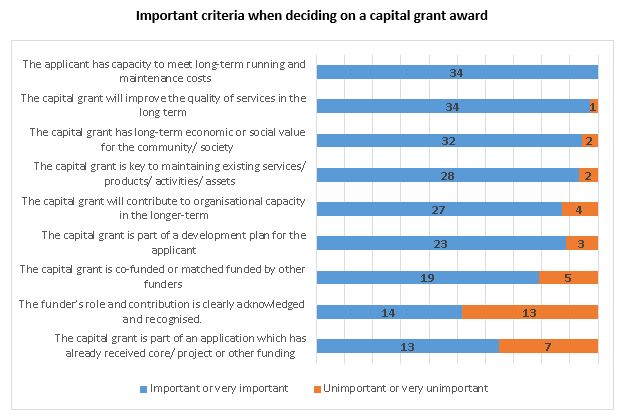

Less than one-half of the funders felt that recognition and acknowledgement of their own role was an important criterion, but it is clearly important that applicants find out which ones these are!

Making a good case

There is considerable variation in what kinds of capital items funders will support. Equipment and building/ renovation was common across most funders. Computer hardware attracted a large majority (75%), followed closely by vehicles. Less tangible areas such as marketing and computer software and pre-funding feasibility and technical assessments were supported by just over one half, while under one-fifth of funders supported collections/acquisitions, and only a few mentioned items like heating systems, wheelchairs and mobility aids, memorials and other physical installations.

Fundraisers should recognise that while the value of a particular item may be overwhelmingly clear to them, it may seem more marginal to potential funders, and communicating the importance of the item will be crucial to success.

Some funders, however, have a very open approach and place most emphasis on the mission which organisations are trying to achieve and the strength of the case made for the value of the capital grant to the process. As one said:

"It’s the organisation that we’re interested in, so it’s about enabling them to deliver on their mission whatever form the support might take."

Factors crucial to the success of individual applications were also explored in the research, and two key messages of different types came through strongly. The first is that applicants must clearly show that they have the capacity to meet long-term running costs, and the second is that the grant will improve the quality of service delivery in the longer-term.

The challenges around getting the costings right should not be under-estimated. Only half of the grantees in the survey got the full amount for which they applied, and most said that this had affected their plans.

On the positive side, capital items can be particularly attractive to fund because their cost can be low compared with revenue and core needs, and in comparison with the scale of the difference they can make to ability to deliver. In other words, they can have powerful leverage.

They are also tangible, often visible, and funders can see the difference they have made, even if it is challenging to measure the benefit. Funders who are willing to invest in charities’ physical capacity understand the value of tangible assets, and that needs can be very basic and unglamorous. One funder in the survey said:

"I got a photograph of a new boiler with a thank you letter saying the outcome of the funding was that they could keep the building open. That was nice!"

Few funders in this survey had themselves offered alternatives to grants, such as loans, loan guarantees or underwriting (or other social investment) for capital items/projects, but two-fifths had suggested that applicants might go down this route.

It will be increasingly important for applicants to show that they have considered funding alternatives, and to clarify why they have come to the conclusion that these are not suitable, even in part. However sympathetic funders are to the value of capital items, they are faced with very hard choices themselves in the current environment. As one commented:

"We ask ourselves whether this is absolutely essential or whether it’s just nice to have. These days, if it's the latter, then we won’t fund it."

Many, however, are increasingly aware that they will need to invest in the long-term sustainability of the sector, and not just meet immediate need.

Capital grant funding has a significant role in long-term sustainability, but in an increasingly tight funding environment, applicants will need to demonstrate fit with mission, make a compelling case for potential benefit to beneficiaries and the wider community, indicate likely outcome and impact as concretely as possible and cost applications realistically, including the consideration of funding alternatives if feasible.

Cathy Pharoah is an expert on funding for the voluntary and charity sector, specialising in philanthropic giving. She is Visiting Professor of Charity Funding and co-Director of the Centre for Charitable Giving and Philanthropy Research at Cass Business School.